On October 26, that is, yesterday, the International Federation of Robotics released the "2022 World Robot - Service Robot" report, which counted the comprehensive trends in this field in 2021.The technology frontier has compiled the key points of the report for everyone at the first time. Let's take a look at the dynamics of the super frontier of service robots.With the development of technology, what changes will the competition pattern of the robot industry have?

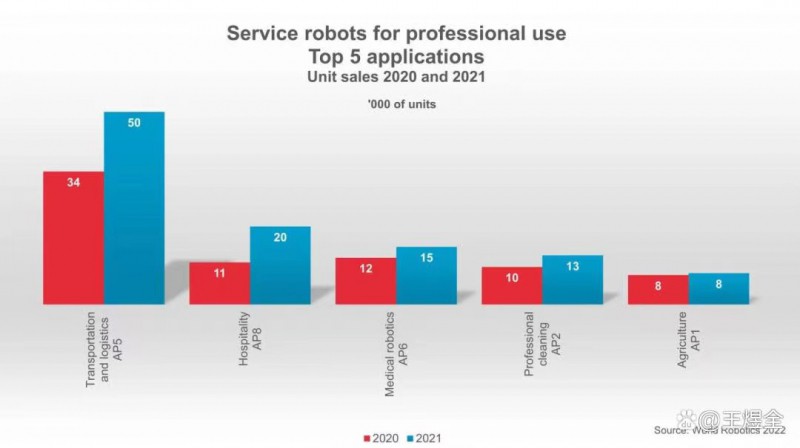

1. Scenario-specific professional service robots are on the riseWhen it comes to service robots, people often think of humanoid robots, but the service robots used in the front-line industry are actually highly customized, including wheeled robots responsible for warehouse transportation, and cleaning robots used in hospitals and airports.According to the division of the International Federation of Robotics, there are five categories of professional service robots with the largest sales in 2021, namely logistics and transportation robots, hotel robots, medical robots, professional cleaning robots and agricultural robots.

According to their statistics, a total of about 121,000 professional service robots will be sold in 2021, one-third of which are used for logistics and transportation, and the usage scenarios are concentrated in the warehousing environment, which also brings the number of manufacturers of warehousing and logistics robots to 286. Hotel robots ranked second. Although they increased by 85% year-on-year, they only sold 20,000 units in total. At present, the most widely used hotel robots are food delivery and remote service. The third place was unexpected. The sales volume of medical robots increased by 23% to 14,000 units. However, most of them are surgical robots, which are actually more precise surgical tools, which are somewhat different from automated robot products. Fourth are professional cleaning robots, which saw a 31% increase in sales. More than 12,000 units. A large part of the increase in sales is due to the sterilization needs of various scenarios after the new crown epidemic. The use of robots to automatically spray disinfectants and ultraviolet irradiation is more cost-effective and more efficient. Of course, according to the statistics of the Robot Federation, some high-altitude glass cleaning , The scene of pool cleaning is also being occupied by robots.

The last category is agricultural robots, with more than 8,000 units sold in 2021, an increase of 6%. Unlike many people's expectations, the biggest application scenario of agricultural robots is not the farming scenario, but the milking and barn cleaning, but there are not many applications in the planting scenario.This is actually easy to understand. The more standardized the scene robot application is, the easier it is.

2. The largest robot market is still the consumer sector After talking about the gratifying growth of professional robots, the overall sales volume and the ratio of consumer-oriented service robots are still not worth mentioning.

Home service robots are mainly used for indoor vacuuming and garden mowing, with a total of 19 million units sold in 2021, a year-on-year increase of 12%). In terms of subdivision, household sweepers still account for the majority. Today, many people have one in their homes. The International Federation of Robotics also expects that the sales of robots in this category will still be high, but the growth rate will begin to slow. Everyone expects that there will be a large market for home care robots in the future, but technically there is still some distance. 3. The competitive landscape of service robots is changing A highlight of this report is the analysis of the service robot industry structure. The International Federation of Robotics found that the service robot industry is very young, but 87% of the manufacturers in the industry are not young, and most of them were established before 2017.

They found that the share of start-ups has been declining in recent years, speculated to be due to a shift in the focus of development at the forefront of the industry to software and application development, with many service robot vendors moving away from developing their own hardware and using third-party products instead Service development is provided on hardware, and these manufacturers are not considered service robot manufacturers. In fact, the deeper reason behind this change lies in the changes in the industrial competition pattern. During the period of staged stagnation of robot technology, the market segments like sweeping robots and logistics robots are already close to saturation, and start-ups will naturally not choose asset-heavy production if they want to cut in again. It is an understandable routine to adopt the asset-light operation of software development. On the other hand, the saturation of robot hardware has indeed spawned the need for secondary development. In today's imperfect robot software system, how to apply robots to production and service scenarios is a problem faced by many companies. Driven by such demand, It is a natural choice for a startup to transform into software development. Of course, the revolution in the robotics industry is still in technology, and it is hard to say how long today’s pattern can be maintained. It is very likely that today’s competition will not be decided, and tomorrow’s technological changes will stir up changes in the industrial pattern.